How to Open a Forex Trading Account: A Step-by-Step Guide

Forex trading has gained immense popularity as a lucrative investment option in recent years. If you’re looking to dive into the forex market, the first step is to open a forex trading account. This article aims to walk you through the process of opening a forex account in a clear and straightforward manner. To get started, you may want to explore how to open a forex trading account Top LATAM Forex Platforms that can offer you the best trading experience.

Step 1: Understand Forex Trading

Before you open a forex trading account, it’s crucial to understand what forex trading entails. Forex, or foreign exchange, involves trading currencies and is one of the largest financial markets in the world. Traders speculate on the value of one currency against another. It’s essential to familiarize yourself with terms like pip, spread, leverage, margin, and more. Understanding these concepts will equip you with the knowledge you need to navigate the trading world effectively.

Step 2: Choose a Reliable Forex Broker

The next step is to choose a forex broker. A broker acts as your intermediary in the forex market. It’s important to select a broker that is reputable, has a user-friendly trading platform, and offers competitive spreads. Research different brokers by reading reviews and checking their regulation status. Look for platforms that are transparent about their fees and trading conditions. Additionally, consider factors like customer support, available trading tools, and the variety of currency pairs offered.

Step 3: Complete the Registration Process

Once you’ve selected a broker, it’s time to open your trading account. This usually involves filling out an online application form with personal information such as your name, address, date of birth, and phone number. Brokers may require proof of identity, which can include submitting a copy of your ID or passport, along with a recent utility bill to verify your address. This process is put in place to comply with regulatory standards and to prevent fraud. Ensure that the information provided is accurate to avoid delays in account verification.

Step 4: Fund Your Account

After your account is verified, the next step is to deposit funds into your trading account. Most brokers offer various funding methods like bank transfers, credit/debit cards, and e-wallets. Check the minimum deposit requirement of your broker and make sure to choose a method that suits you. Remember to consider any associated fees with each funding method. Once the funds are in your account, you’re ready to start trading.

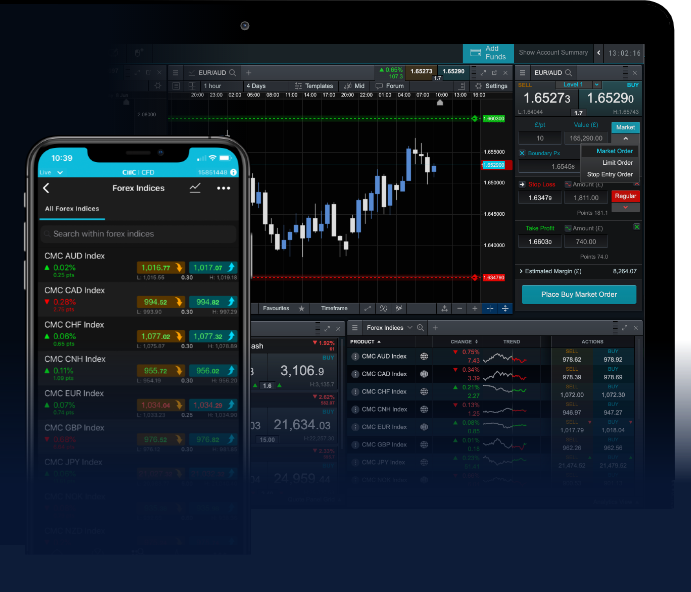

Step 5: Download Trading Software

Most forex brokers offer trading platforms, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which you can use to execute trades. You will need to download and install the software or use a web-based version, depending on what the broker offers. Familiarize yourself with the platform’s features, including how to place orders, analyze charts, and manage your account. Many brokers also provide demo accounts where you can practice trading without the financial risk, giving you the chance to build your skills before trading with real money.

Step 6: Develop a Trading Strategy

Having a solid trading strategy is vital for success in forex trading. A good strategy takes into account market trends, analysis techniques, risk management, and your financial goals. Traders employ various strategies, such as scalping, day trading, and swing trading. Determine whether you want to trade frequently or hold positions for an extended period. Use technical analysis, fundamental analysis, or a combination of both to inform your trading decisions. Testing your strategy on a demo account can provide insights into its effectiveness before applying it in a real trading scenario.

Step 7: Start Trading

With your account funded, platform installed, and strategy in place, you can begin trading. Start small and manage your risk carefully. Use tools like stop-loss orders to minimize potential losses. Keep track of your trades and analyze the outcomes regularly to adjust your strategy as needed. Remember that forex trading carries risks, and it’s essential to trade with discipline and patience.

Step 8: Continuous Learning

The forex market is constantly evolving, and so should your trading skills. Engage in ongoing education through online courses, webinars, trading forums, and books. Stay updated on market news and economic events that may impact currency values. Learning from your experiences and adapting to changes in the market can vastly improve your trading performance.

Conclusion

Opening a forex trading account is a significant first step toward entering the exciting world of currency trading. By understanding the basics, selecting the right broker, and developing a solid trading strategy, you can enhance your chances of success in the forex market. Remember to stay informed, be patient, and practice responsible trading. Happy trading!

Comentarios recientes