Mastering Forex Trading Practice: Tips and Strategies

Forex trading is a dynamic and exciting field that offers numerous opportunities for profit. However, it also requires considerable skill, knowledge, and practice to become successful. Engaging in forex trading practice Qatar Brokers can provide valuable resources to improve your trading. This article will guide you through essential forex trading practices, exploring strategies that can help you refine your trading style and enhance your financial outcomes.

Understanding the Basics of Forex Trading

Before delving into specific practices, it’s crucial to grasp the fundamentals of forex trading. The forex market is the largest and most liquid financial market globally, boasting a daily trading volume exceeding $6 trillion. Traders engage in this marketplace to exchange currencies with the aim of making profits based on currency price fluctuations.

Key Concepts

1. Currency Pairs: Forex trading involves trading currency pairs, such as EUR/USD or GBP/JPY. The first currency is the base currency, while the second is the quote currency.

2. Pips: The smallest price movement in a currency pair, typically the fourth decimal place (e.g., 0.0001).

3. Leverage: A tool that allows traders to control larger positions with a smaller capital base, amplifying both potential gains and losses.

4. Lot Size: The volume of a trade. In forex, a standard lot is 100,000 units of the base currency.

The Importance of Practice in Forex Trading

Practice is an integral part of becoming a successful forex trader. Like any skill, trading requires repetition, learning from mistakes, and adapting strategies over time. First and foremost, it’s critical to have a clear trading plan that outlines your goals, risk tolerance, and strategy.

Simulated Trading and Demo Accounts

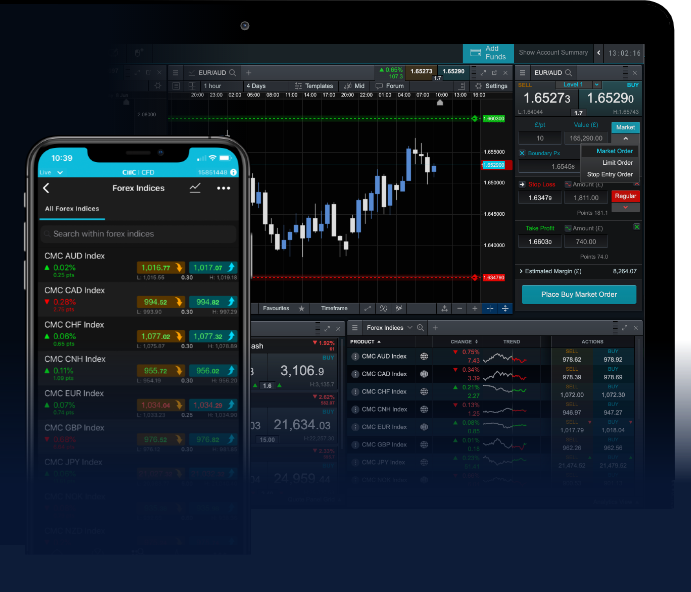

Before you start trading with real money, consider using a demo account. Most reputable forex brokers offer demo trading features, allowing you to practice without financial risk. This environment provides the opportunity to familiarize yourself with trading platforms, strategies, and financial analysis tools.

Using a demo account helps you understand market behavior and develop a trading style. Here are some essential tips for using demo accounts effectively:

- Treat It Like Real Trading: Use real-world conditions, such as setting realistic trading goals and risk management. This mindset will prepare you for actual trading scenarios.

- Experiment with Strategies: Use the demo period to test various trading strategies—scalping, day trading, swing trading, or positional trading—to discover what works best for you.

- Keep a Trading Journal: Document every trade, including your analysis and rationale. This will help you understand your decision-making process and identify areas for improvement.

Developing a Trading Strategy

Having a well-defined trading strategy is paramount to success in forex trading. There are numerous strategies that traders can employ, and the right one depends on individual preferences, risk tolerance, and market conditions. Here are a few popular strategies:

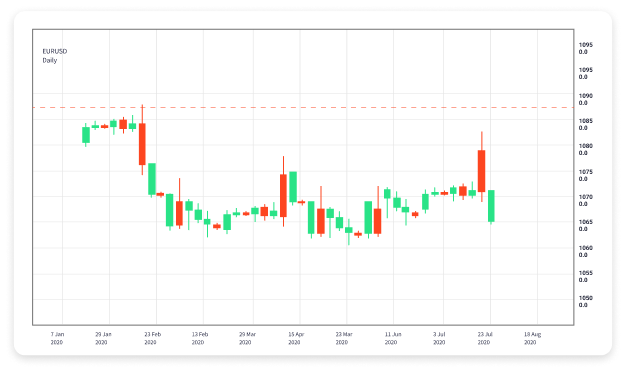

1. Technical Analysis

This approach involves analyzing price charts and using technical indicators to predict future price movements. Key indicators include moving averages, relative strength index (RSI), and Fibonacci retracement levels. Utilizing these tools can help identify potential entry and exit points.

2. Fundamental Analysis

Fundamental analysis focuses on economic indicators, news events, and geopolitical events that may impact currency prices. Understanding how economic data such as interest rates, employment figures, and inflation rates affect currency movements is essential for informed trading.

3. Price Action Trading

This method emphasizes trading based on price movements rather than relying heavily on indicators. Price action traders analyze patterns and trends directly from price charts to make trading decisions.

Risk Management in Forex Trading

Risk management is crucial in mitigating potential losses in forex trading. Here are some essential risk management practices:

- Setting Stop-Loss Orders: A stop-loss order automatically closes a trade when the price reaches a certain level, limiting potential losses.

- Diversification: Avoid putting all your capital into one trade or currency pair. Spreading your investment across different pairs can lower risk.

- Using Proper Leverage: While leverage can magnify profits, it can also increase losses. Be cautious in how much leverage you use.

Continuous Learning and Adaptation

The forex market is constantly evolving, influenced by changes in economic conditions, technological advances, and market sentiment. Therefore, continuous learning is vital for any trader. Keep up with market news, read trading books, and enhance your skills through webinars or online courses.

Conclusion

Forex trading offers significant potential for profit, but it requires a disciplined approach, continuous practice, and effective risk management strategies. By utilizing demo accounts, developing a solid trading strategy, and staying informed about market changes, traders can enhance their skills and work towards achieving their financial goals. Remember, every successful trader has gone through the process of learning and practicing—so start your forex trading journey with determination and an eagerness to grow!

Comentarios recientes