This means that for every $1 in shareholder equity, the company has $2 in debt. If your company had $100,000 in debt, and your balance sheet showed $75,000 of shareholders’ or owners’ equity, then your gearing ratio would be about 133%, which is generally considered high. Generally, the rule to follow for gearing ratios – most commonly the D/E ratio – is that a lower ratio signifies less financial risk.

What is the formula to calculate the capital gearing ratio?

For instance, a company with a gearing ratio of 60% could be regarded as high risk when evaluated in isolation. However, when compared to its key competitor that reports leverage of 70% and the industry average of 75%, the company’s debt levels appear more satisfactory. High levels of gearing and leverage indicate that a company relies heavily on debt to finance its long term needs, which increases the level of risk for the company’s common ordinary shareholders. Gearing ratio helps us in assessing how much financial leverage a company has. This important financial metric displays the ratio of a company’s debt to equity capital. The ratio shows how much debt or equity is used to fund a business’s operations.

Understanding Gearing

Where D is the total debt i.e. the sum of interest-bearing long-term and short-term debt such as bonds, bank loans, etc. It also includes other interest-bearing liabilities such as pension obligations, lease liabilities, etc. E stands for shareholders equity which includes common stock, additional paid-up capital, retained earnings, irredeemable preferred stock, etc. Companies with low gearing ratios maintain this by using shareholders’ equity to pay for major costs. Monopolistic companies often also have a higher gearing ratio because their financial risk is mitigated by their strong industry position.

Would you prefer to work with a financial professional remotely or in-person?

From our modeling exercise, we can see how the reduction in debt (i.e. when the company relies less on debt financing) directly causes the D/E ratio to decline. In general, the cost of debt is viewed as a “cheaper” source of capital up to a certain point, as long as the default risk is kept to a manageable level. We will first calculate the company’s total debt and then use the above equation.

A higher gearing ratio suggests that a company is more heavily financed by debt, which can increase financial risk but also potentially enhance returns on equity. Companies in monopolistic situations often operate with higher gearing ratios because their strategic marketing position puts them at a lower risk of default. Industries that use expensive fixed assets typically have higher gearing ratios because these fixed assets are often financed with debt. These ratios highlight if the financing structure of the business is stable and leverage remains under control. Again, it’s an excellent tool for lenders to assess if the business/financial risk aligns with the risk appetite. Further, the price setting of the loan and other terms are also dependent on the same.

- Gearing (otherwise known as “leverage”) measures the proportion of assets invested in a business that are financed by long-term borrowing.

- Using a company’s gearing ratio to gauge its financial structure does have its limitations.

- A gearing ratio is a financial ratio that compares some form of capital or owner equity to funds borrowed by the company.

- A higher gearing ratio indicates that a company has a higher degree of financial leverage.

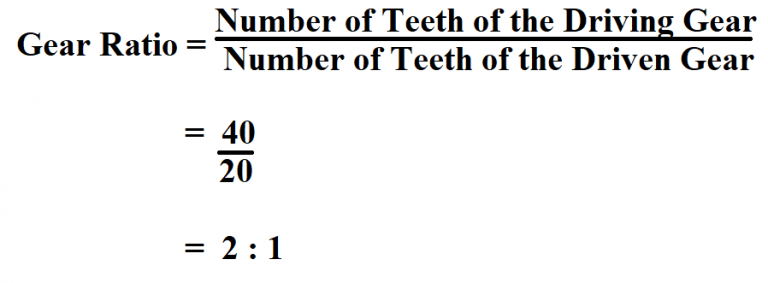

- Many devices that we use in our day-to-day life there working principles as gears.

Issue Shares

When an organisation has more debt, there is a higher risk of financial troubles and even bankruptcy. Capital that comes from creditors is riskier than money from the company’s owners since creditors still have to be paid back even if the business doesn’t generate selling general and administrative expenses sganda income. A company with too much debt might be at risk of default or bankruptcy especially if the loans have variable interest rates and there’s a sudden jump in rates. Net gearing can also be calculated by dividing the total debt by the total shareholders’ equity.

The gearing ratio is essentially a measure of financial leverage, indicating how much of a company’s operations are funded by debt versus equity. A company’s financial leverage is its total assets divided by its shareholders’ equity. The result shows a comparison between total assets owned by the company versus shareholders’ ownership. A high ratio indicates that a good portion of the company’s assets are funded by debt. Hence, gearing ratios are usually used as a tool to compare financial leverage of similar companies within one industry sector.

A gearing ratio is a financial ratio that compares some owner equity (or capital) form to funds lent by the company. One can also calculate net gearing by dividing the total debt by the shareholders’ equity. A positive gearing ratio indicates that the company has more debt than equity, implying higher financial leverage.

A company whose CWFR is between 30% to 50% of its total capital employed is said to be medium geared. Also, a company whose CWFR is below 25% of its total capital employed is said to be low geared. The Debt-to-Equity Ratio describes the total debt that the company draws against the total equity that the owners of the company have raised.

Gearing ratios provide an insight into how a company funds its operations, relative to debt and equity. Using gearing ratios as part of your trading fundamental analysis strategy helps to provide crucial financial ratios that can be utilised to make smarter trading decisions. Continue reading to learn about key features of gearing ratios and how they can support your decision-making.

When looking at a company’s gearing ratio, be sure to compare it to that of similar businesses. In this formula, “Total Debt” includes all of a company’s short-term and long-term liabilities, while “Total Equity” represents the shareholders’ equity. Typically, a good gearing ratio is below 0.5, meaning the company has less debt than equity. More recently, with interest rates staying low, some companies have started using debt again to fund growth. However, businesses today are much more careful, balancing their debt and equity based on the economy and their industry’s needs.

Recent Comments